Tonnes of GHG Emissions Avoided

Helios provides high annualized returns while maximizing capital gains upon exiting investments.

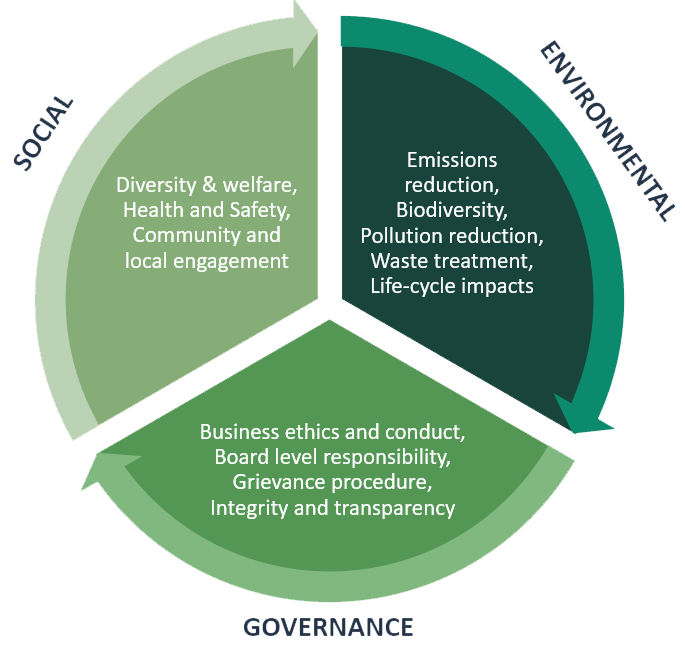

Helios is committed to responsible investing and incorporates ESG across its investment lifecycle to protect and create value in its portfolio over the long term.

Predominately investing in the Renewable Energy Sector, Helios has contributed substantially to the avoidance of harmful Green House Gas (GHG) emissions across its investment portfolio.

Tonnes of GHG Emissions Avoided